Cathay Innovation Renews its Trust and Investment in USHOPAL as it Raises Another $100 Million to Strengthen its Leadership as an Omni-channel Luxury Brand Accelerator

March 19, 2021

Asia

March 2021, SHANGHAI – USHOPAL, a Chinese luxury brand management group and omnichannel retailer, announced the closing of its latest $100 million funding round, driving up its total investment to $200 million. These funds will serve to bolster the already rapid growth of USHOPAL’s portfolio brands’ in China and the Asia Pacific. The leading private equity specialist in global branding, FountainVest Partners, which recently acquired ARC’TERYX’s parent company Amer Sports, led the round. Co-investors include Cathay Innovation, Zhongyuan Capital, Hengxu Capital and the Dazhong Zhongsong Fund.

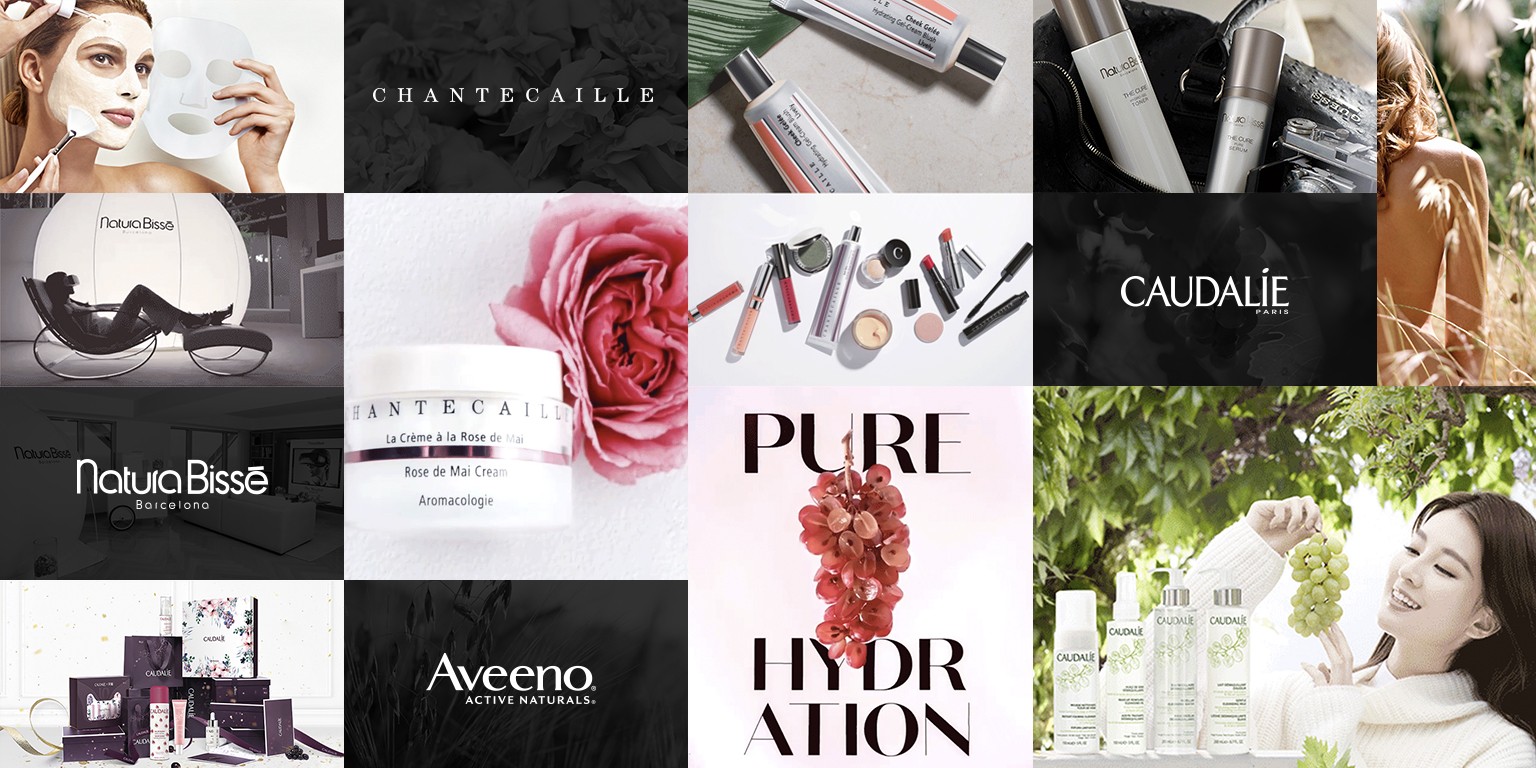

Founded in 2017, USHOPAL raises the brand awareness of global niche luxury brands in China. It accompanied the scale-up of an entire portfolio of luxury brands, including Natura Bissé, Juliette has a gun and Chantecaille into major new players in China, and thus reached a gross merchandise value (GMV) of more than $200 million in 2020. USHOPAL primarily partners with high-end brands sold in leading luxury department stores such as Harrods in the UK, Le Bon Marché in Paris or Neimen Marcus in the US.

USHOPAL provides a broad array of omnichannel services from distribution and commercialization to branding (USHOPAL Studio, USHOPAL Branding), logistics (USHOPAL Global Logistics Fleet) and retail (USHOPAL Tmall, Bonnie & Clyde). USHOPAL’s ecosystem also leverages more than 2500 Key Opinion Leaders (KOL) to adhere and anticipate consumer trends as efficiently as possible.

Since 2019, USHOPAL has begun to increase its capital reserves in order to better align its activities with its long-term growth objectives, to improve the distribution and growth of its portfolio brands in China and the Asia Pacific, and to further support its brands through equity investments. As a recent example, USHOPAL invested in Juliette has a gun, a leading niche perfume brand which USHOPAL helped to rapidly scale in China.

The USHOPAL group also owns the luxury beauty centers Bonnie & Clyde (B&C). Most beauty chains in China focus on sales en masse, sample selling without authorization, and discounts which prevents them from reaching high-end luxury sales points. Whereas B&C has positioned itself as a top luxury channel through its own dedicated shops, KOL community meet ups, and full authorizations. Thus it has successfully established its presence in China’s top tier business circles including the Jing An Kerry Center, HKRI Taikoo Hui, Plaza 66 and K11 Shanghai. All B&C locations record average transaction values in excess of 5,000 RMB ($766), with customers often spending more than 10,000 RMB ($1500).

B&C also benefits from a unique authorization to import cross-border beauty products. Consumers purchase products online and delivery can be completed within 4 hours, with customs duties fully cleared, making B&C the only beauty retailer with this kind of infrastructure.

USHOPAL is currently expanding B&C to other metropolitan areas such as Beijing and Chengdu. Today, it has five centers in Shanghai and will count a total of 11 boutiques by the end of 2021.

Thanks to this funding round, USHOPAL will be able to invest further in its portfolio and its B&C experience centers. The founder and CEO of USHOPAL, Lu Guo, recently emphasized how USHOPAL and its leadership team will continue to leverage their many years of success in brand management and omni-channel retail to build up unique luxury brands into China’s beauty market leaders, and strengthen USHOPAL’s brand matrix to become a globally active and respected player.

Lanchun DUAN, Managing Partner at Cathay Capital, said: “USHOPAL is a platform that has repeatedly proven its ability to build brands and help them grow rapidly at various stages of development. Furthermore, it has successfully risen to become a Chinese beauty brand group respected across the world through global capital operations, mergers and acquisitions. Our venture capital arm Cathay Innovation invested in USHOPAL back in 2016, and we have accompanied and witnessed their successes ever since. I am especially proud of USHOPAL’s reputation across the global luxury brand landscape and of the impressive ecosystem it has developed to this day.”

About Cathay Innovation

Cathay Innovation is a global venture capital partnership, created in affiliation with Cathay Capital, investing in startups at the center of digital revolution across North America, Latin America, Europe, Asia and Africa. Its global platform unifies technology investment across continents, investors, entrepreneurs and leading corporations to accelerate startup growth with access to new markets, invaluable industry knowledge and introductions to potential partners from the start. As a multistage fund with over $1.5 billion assets under management and offices across San Francisco, New York, Paris, Shanghai, Beijing and Singapore, Cathay Innovation partners with visionary entrepreneurs and startups positively impacting the world through technology.

To learn more, please visit www.cathayinnovation.com or follow us on Twitter @Cathayinnov.