Ecosystem Outlook: The Global Hydrogen Energy Market & Cross-border Synergies

Mai 19, 2021

Asien

Carbon neutrality is one of the world’s most urgent missions. According to the UN, countries representing more than 65% of harmful greenhouse gasses and more than 70% of the world economy have committed to achieving net-zero emissions by 2050. Achieving the mid-century carbon neutral target requires concerted efforts from countries around the world with hydrogen energy gaining considerable recent momentum.

In July 2020, the European Union announced the “EU Hydrogen Strategy”, committed to investing 575 billion € over the next 10 years. Meanwhile, the Chinese Ministry of Science and Technology (MOST) named hydrogen energy as a key priority for national R&D, with six of the listed projects being directly related to fuel cells and 13 focused on hydrogen as a new energy deployment. From China, Japan or South Korea and Europe to North America, the importance of hydrogen has long crossed geopolitical boundaries and is now an issue of global development. This new phase of global energy reform is breaking the boundaries of traditional businesses, requiring greater integration of all key players to move forward — a true ecosystem-level effort is critical.

At Cathay, we are uniquely positioned to leverage resources from around the world to fuel cross-border collaboration. We don’t see ourselves as strictly global investors, but rather ecosystem builders connecting all players – from traditional LPs, corporate investors to startups – to maximize collaboration and value creation. Under Cathay Innovation, the Cathay Smart Energy Fund is an important investment vehicle dedicated to the Chinese energy market and energy related technology innovations, where we leverage our deep market expertise and extensive network to embed, expand and develop the wider energy ecosystem while empowering portfolio companies through potential customers, partnerships, R&D and more.

Led by Partner Zhang Li, the Cathay Smart Energy team works closely with our ecosystem, including Fortune500 energy corporations, across three continents to share knowledge and identify the key trends that will define the future of energy in China and the world. In February of 2021, we held a virtual workshop, hosted by Investment Director Dr. Jing Zhao, to explore the global hydrogen energy market and discuss cross-border synergies that can help push the industry forward. Participants included pioneers and market leaders across China and Europe from various parts of the industry such as Cathay portfolio company REFIRE, a pre-IPO Chinese leader in fuel systems, along with strategic partners in our ecosystem and committed investors in our funds Total, Total Carbon Neutrality Ventures, Air Liquide, Michelin, Groupe ADP (Aéroport de Paris), Airbus and Valeo.

The discussion focused on sharing stakeholder views around the current market, the future opportunity, collaboration, government support along with the core pain points (e.g., cost, volume and infrastructure) that are hampering hydrogen development. Below, we’ve extracted some of the key points.

The Cathay Smart Energy Take on Hydrogen: Hype or New Era?

Companies across the world are trying to find the best ways to harness the power of hydrogen to generate energy from China’s SinoHytec, who listed on STAR market last year in a billion yuan IPO, to Plug Power in the US or Ballard Power Systems in Canada. Technology innovation in the space covers everything from the design and manufacturing of hydrogen fuel cells, new methods of production, storage, infrastructure to hydrogen-powered mobility solutions.

The benefits are clear: hydrogen energy is light, storable, energy-dense, and doesn’t produce direct emissions of greenhouse gases. Many believe it to be the energy or fuel of the future given its potential in decarbonizing some of the most intensive sectors from long-haul transport, aviation, manufacturing, to chemicals, heating or consumer transportation. As demand for hydrogen surges, with the urgent need for clean energy (and clean transportation), investors are pouring more capital into companies at higher valuations. For example, Hyzon Motors, a hydrogen powered truck and bus manufacturer, recently announced its plans to go public via a SPAC merger valuing the company at $2 billion.

In 2020, the Chinese fuel cell vehicle (FCV) market counted over 7,000 vehicles with 101 fueling stations — trailing behind Europe (180) and Japan (137). However, we’re currently seeing rapid development, largely driven by the SinoHytec IPO and the release of new government subsidy policies with China seeing a 457% increase in new hydrogen companies registered in just five years, bringing the total number to over 2000. This is incentivizing industrial players to enter from the sidelines, such as China’s Sinopec which recently committed to building 1,000 hydrogen refueling stations in the next five years.

However, the capital markets may be ahead of the products. While hydrogen has huge potential in the global energy revolution and the transition to clean energy, many challenges persist with one of the biggest hurdles being cost and another being infrastructure. In order to make the hydrogen economy a reality, we need to speed up our learning rate, bring costs down and build the infrastructure to scale — and not one individual, company or even country can do it alone, it will take the global ecosystem.

Dr. Jing Zhao, Investment Director, Cathay Smart Energy Fund

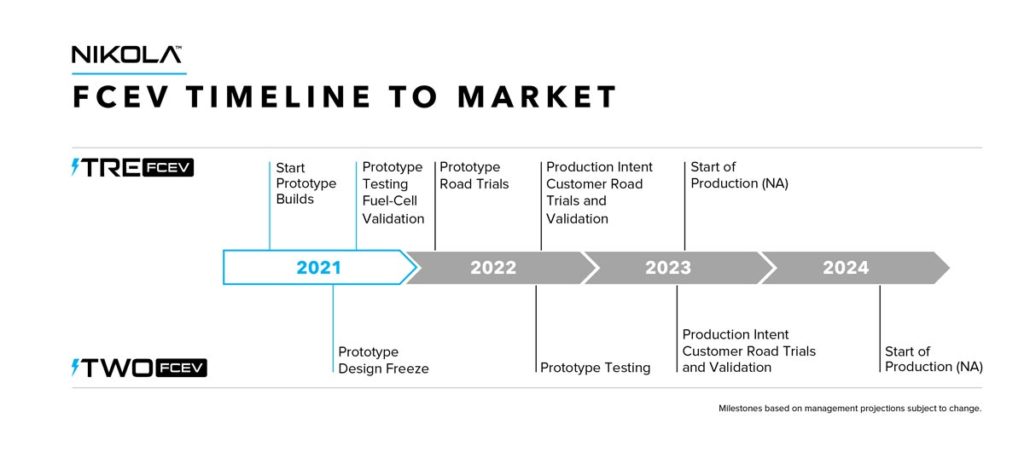

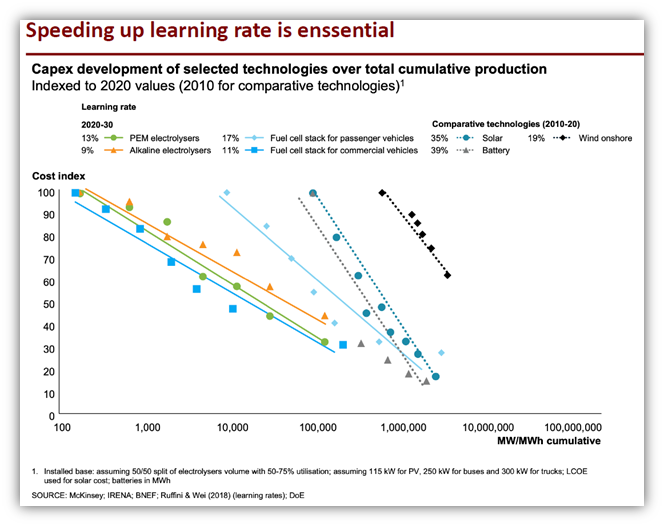

Dr. Jing Zhao shares his thoughts on the hydrogen market from a global lens as the sector continues to gain momentum with several significant recent events: “There have been more and more IPOs in the hydrogen sector with very high valuations, yet relatively immature development or products have been disclosed, which means bubbles do exist in this domain. However, we firmly believe that the market need for clean transportation and energy is there and will indeed increase, and this is the source of these high valuations. The challenge is in determining how to bring the technology into real case scenarios with cheaper costs. In this aspect, we are convinced that speeding up the learning rate and forging global partnerships are key. While comparative tech such as battery and solar learning rates are nearly 40%, the fuel cell stack remains less than 20% and with very high prices. It seems that the capital market is more ready than the products (see image above) and the question remains – how can we speed up the learning process and bring down costs? This is the crucial point we invited our energy ecosystem friends to debate.”

Image source: Hydrogen Council – Path to hydrogen competitiveness A cost perspective – https://hydrogencouncil.com/wp-content/uploads/2020/01/Path-to-Hydrogen-Competitiveness_Full-Study-1.pdf Data source: Mckinsey, IRENA; BNEF, Ruffini & Wei (2018) – https://hydrogencouncil.com/wp-content/uploads/2020/01/Path-to-Hydrogen-Competitiveness_Full-Study-1.pdf

Insights from Cathay’s Energy Ecosystem:

Total Carbon Neutrality Ventures: Why Hydrogen Infrastructure is Critical to Avoid EV’s “Chicken-and-Egg” Issue

Girish Nadkarni, President of Total Carbon Neutrality Ventures; Team Leader at Clean Hydrogen Fund

Together with Air Liquide, and other industry players, Total has launched a €2B hydrogen infrastructure fund that brings together strategic investors across the global value chain from hydrogen producers, OEMs, fleet owners, automotive businesses, aviation and construction to traditional financial investors, particularly from regions where energy is a critical component such as the Middle East, Canada and Norway. The goal is to kickstart the hydrogen ecosystem, starting with mobility, primarily investing in infrastructure along with the technology and building blocks that will power the industry.

“As someone once said about nuclear fusion, it’s the energy of the future and will always be the energy of the future. Some people felt the same way about hydrogen energy over the last 20 years, but unlike nuclear fusion, it’s now come to the point where it can be commercialized. While we still need a level of government support, we are on the cusp of making hydrogen a reality.

If you recall the electric vehicle market, we had a chicken-and-egg situation. People weren’t buying EVs due to concerns around range and not having enough charging stations, while at the same time, charging stations weren’t being installed due to there not being enough EVs purchased. We can address this by financing both the acquisition of fleets and installation of hydrogen refueling stations at the same time — creating a region-by-region infrastructure to ensure density.

Many players within the ecosystem are waiting for something to happen, we need to light the spark, encourage others to step in and send a strong signal to governments to speed up regulatory infrastructure, subsidies and grants to push the industry forward.”

REFIRE: The Commercialization of Fuel Cell Technology & How to Drive Down Costs through Tech, Volume & Government Support

Audrey Ma, VP International Business, Marketing & Communications, REFIRE

REFIRE, a Cathay portfolio company, is a leading pre-IPO hydrogen startup in China that has powered over 2,730 Fuel Cell Vehicles (FCVs) through proprietary fuel cell technologies. For fuel cell transport usage, REFIRE has built products and technologies catering to the Chinese market and is now branching out internationally. Hydrogen energy is a great way to tackle the problems of global pollution and climate disruption and FCV commercial vehicles – trucks and heavy-duty vehicles – provide an opportunity to make a major impact without the need for significant infrastructure development.

“The future is bright, but there’s still a long way to go before hydrogen can become established as a foundation for everyday life. Many partners have clear plans to bolster their hydrogen operations, including oil and gas companies such as Sinopec, Air Liquide, Shell, Total and BP. Businesses across the automotive industry are now developing practical hydrogen fuel cell products and components.

There is a changing mood among end-users, especially in China, who want to trial and use our products. They naturally want assurance that supporting infrastructure and a full range of products are available and we believe that we can meet their needs.

One key question that remains is: how to drive costs down? From the industry side, technology advancement and volume growth are key factors. Technology is advancing rapidly across the entire value chain of hydrogen production including refueling station infrastructure, fuel cell products and end-applications. To achieve the all-important cost reduction, volume growth is critical and FCEVs are leading the way.

Volume will also increase through partnerships driven by the global alignment on carbon neutrality. It is clear that stakeholders are aligned, with actionable steps, to produce hydrogen and fuel cell products in volume to create a more robust supply chain in order to meet the decarbonization mandate. A third factor, and a very important one, is government intervention. There’s been quite a lot of funding poured into supporting fuel cell adoption — a strong incentive to drive down costs while increasing volume.”

Airbus & Group ADP: Decarbonizing Aviation for Sustainable Travel with Hydrogen – Powered Zero-Emission Commercial Aircrafts

Pierre Vialettes, Global Head of Technology Scouting, Airbus

Airbus aims to bring a zero-emission commercial aircraft, powered by hydrogen, to the market by 2035 — dubbed ZEROe. It’s developing three game-changing concepts that demonstrate the versatility hydrogen can bring to aviation (1) Turbofan (2) Turboprop (3) Blended-Wing body. Airbus is exploring various technology pathways and aerodynamic configurations and is looking to collaborate with all global stakeholders on a variety of topics – from storage and production to distribution – to drive down infrastructure and energy costs to enable sustainable air travel.

“We’re working towards the decarbonization of aviation and investing in our shared future with airlines, which will be a zero-emission future. Today, we already offer the most eco-efficient aircraft family from the A220 to the A350, providing 25% CO emissions reductions compared to the previous generation. We are now exploring various technologies in hydrogen propulsion to power future aircraft.

Despite the COVID-19 pandemic and its impact on travel, we are still seeing huge growth, which means more aircraft and more emissions under the current status quo. The entire aviation industry has committed to reducing emissions by 50% by 2050 and the zero-emission aircraft concept will play a key role in how we get there.”

Blandine Landfried, Hydrogen Airport Project manager at Groupe ADP (Paris Airports)

Groupe ADP is working towards the long-term goal of operating the hydrogen aircraft by 2035. Handling huge amounts of liquid hydrogen is a challenge to tackle for airports – so every aspect needs to be considered: changes in industrial and airport regulations, preparation of H2 infrastructures, analysis of impacts on aircraft operations and adaptation of airport infrastructures. In the short term, airports are contributing to the development of the hydrogen ecosystem and the use of hydrogen within the whole airport city for mobility, logistics, freight or ground handling activities, energy and heat supply for buildings.

“The advent of the hydrogen aircraft is a technological revolution that is being prepared today on a territorial scale and requires the development of hydrogen airport ecosystems to massify the uses of hydrogen and prepare large scale use of hydrogen.“

Air Liquide: Speed Vs. Patience in Hydrogen’s Learning Curve and the Importance of Investing in the Entire Supply Chain

Rong Zhou, Head of Hydrogen Business Development, Air Liquide Hydrogen

Air Liquide is a global leader in the hydrogen market actively developing the ecosystem worldwide. In China, hydrogen is consistent with many long-term goals: reducing carbon emissions, increasing renewable deployment, lessening raw materials imports for batteries, decreasing oil and gas import dependency and improving air quality. By 2050, it’s predicted that hydrogen will account for 10% of the end-energy mix and become an important part of China’s strategy. Of the hydrogen use-cases, transportation will account for half, with 80M fuel cell vehicles, and the rest dedicated to building heating, industrials, chemicals and materials. Air Liquide’s focus is on production and distribution while ensuring through partnerships and deconsolidation that the downstream structure can be deployed.

“Technology is not magic. It will take time for OEMs, the fuel cell vehicle value chain and the hydrogen supply chain to work on the technology. This is normal. At the beginning, costs are always high which is why we need government intervention or regulations to stimulate the volume and scale of the market. And we can’t run too far, too fast, because if we don’t get it right, the money will start flowing somewhere else. We learned from EV and we have to do better this time.

Total Gas Mobility: Hydrogen’s EV advantage in Heavy Duty Vehicle Applications

Christian Nissing, Head of Strategy, Marketing & Innovation, Total Gas Mobility

In Total’s 2020 Energy Outlook, the company outlines how moving towards net zero will require a revolution in transport with low-carbon hydrogen emerging as a promising contributor. While hydrogen has big potential in industry (e.g., steel, petrochemicals, cement), storage and gas networks, one of the most impactful areas is its application in transport (gas & H2-based liquids), particularly in heavy duty vehicle applications. Total is exploring both liquid and compressed hydrogen and currently has close to 30 hydrogen refueling stations (HRS) across Germany, the Netherlands, and Belgium, and is developing numerous projects to prepare the market for broader hydrogen for mobility adoption including its JV in Germany H2 Mobility and the world’s first mobile HRS station to be deployed on racetracks with Mission24.

Air Liquide has been working on a variety of hydrogen technologies for the last 30 years — we already know the best ways to produce, transport and refill. The technology is mature, but the issue is in the volume and we can’t expect a huge jump while costs are high. We’re investing in the sector, and the larger supply chain, because there are a variety of potential solutions. For example, 95% of hydrogen production is still from fossil fuel — but it’s something we’re working on. We’re investing in electrolyzer technologies and taking a lead in the industry to demo it.”

“For longer distances that need to be covered, hydrogen is of particular interest for buses and medium to long haul transportation trucks. From the retail point of view and fuel distribution, there is a huge upside as hydrogen refueling can be done really quickly with one minute getting a light vehicle around 150km (similar to traditional gas) compared to only 20km for EVs.

As long as the market is not economically viable, price, regulations and policy will be the biggest drivers in determining the future of hydrogen. We’ve seen strong support in the past, particularly in Germany over the last 12 months, with new programs being set up in European countries pushing development forward for hydrogen and mobility generally.

It makes sense to move into the B2B heavy truck segment in this critical learning phase where driving distances are higher, requiring more volume, and consumption is more predictable than for light vehicles. This makes it easier to develop stations at locations where there is a larger concentrated demand and helps us increase the volume — which reduces operating costs. Focusing on heavy duty application is a good first step to bringing overall costs down.”